Condo Financing 101: A Comprehensive Guide for Beginners

By: Melecio Martin G. Arranz IV

Buying a property is one of the biggest financial decisions a person will ever make. Whether it is for investment or personal housing, you will have to be wise on how you finance a property purchase.

Federal Land offers three payment terms: Cash Term, Bank Financing Term, and In-house Financing Term. To help you decide which financing option is best for you, here is a short guide of payment options, housing loan calculator, and amortization tips.

3 Condo Financing Options

Payment terms vary per project. Typically, Federal Land offers three payment terms: Cash Term, Bank Financing Term, and In-house Financing Term.

1. Cash Term

Cash term means paying cash up front within a 30-day or 60-day period. The easiest and fastest way to homeownership, cash term means you can enjoy certain advantages such as discounts, fewer requirements, easier and quicker processing of real estate documents and no long-term payment concerns.

For cash term, the following are the factors you should consider:

- Allotted funds for the closing costs and the Total Contract Price (TCP) to be paid within the 30-day or 60-day period

- Discount offered as compared to your foregone investment earnings for in-house financing

- Interests attached to the other payment terms

- Advantages of installment options

- Easy transaction and documentation

2. In-house Financing Term

In-house financing is an extended payment term with above-average interest rates offered by the developer. Federal Land offers in-house financing payable in five to ten years for 80% of TCP or a maximum amount of Php 5 million with a fixed interest rate for the first five years, then subject to review for succeeding years.

While banks are known for their strict housing loan application, in-house financing has a relatively low risk of being denied. A down payment of 20% to 30% of the TCP is enough to guarantee.

Requirements for in-house financing include a certificate of employment indicating position, length of service and compensation, your latest Income Tax Return, your latest pay slip, and utility bills.

For foreigners and non-permanent residents of the Philippines, in-house financing and cash term are the only available payment options, since bank financing have a required number of years of residency in the country and familial ties to support loan agreements.

3. Bank Financing Term

A bank financing term is an agreement between the lender (a bank) and the borrower (the homebuyer) wherein the borrower pledge to pay the loan or mortgage over an agreed period or loan tenure.

Depending on the bank policy, property value and paying capacity, a buyer can loan up to 90% of TCP and pay for the loan and its interest for up to 25 years. The homebuyer would then shoulder the remainder of the TCP or the equity. However, some real estate projects may have a limited allocation of units offered for long-term payment via bank financing options. It would be best to verify the real estate project being offered and the availability of units allowed for this type of payment before making a decision to buy.

For bank financing, the factors are similar to in-house financing, except for lower interest rates, stricter bank documentary requirements, and the benefit of having the Title transferred to your name sooner if you use a different property as your collateral. If you choose to use the property you purchased as your collateral, the Title will be transferred to your name; however, it will be kept by the bank until you complete your mortgage payments.

For all projects of Federal Land, a homebuyer can apply a housing loan to its accredited banks: Metrobank and PS Bank. Selected Federal Land projects also accept housing loans from PNB Savings Bank, UCPB, Banco De Oro, Union Bank and Chinabank. It would be good to buy during the pre-selling period of real estate projects during which time there are units available for bank financing payment option.

What is monthly amortization?

Should you choose either bank or in-house financing to pay off your condominium, you will have a monthly obligation called amortization.

Amortization is an accounting process of spreading payments over a specified time. A mortgage due to be paid in 20 years, will have the same amount due every month for 20 years with the first few installments going towards payment of interest before reducing the loan balance or principal.

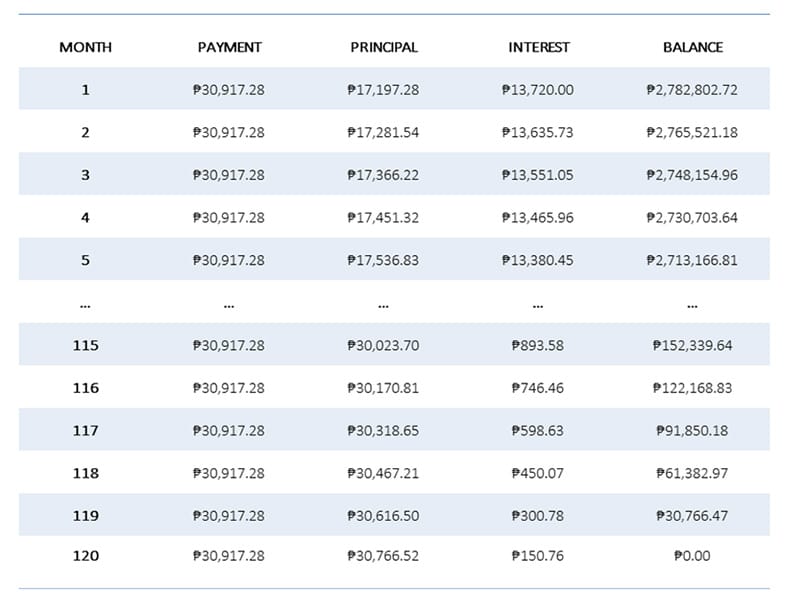

To illustrate, see below an example of amortization table (or amortization schedule) for a mortgage of Php 2,800,000 with a five-year fixed rate of 5.88% payable in 10 years.

A Sample Condo Amortization Schedule

In the table, you will notice how your monthly payments affect the loan and the interest. While each monthly fee is the same, the portion of each payment changes over time. At the beginning of a long-term loan, payment to interest is higher than to principal. As you progress to the middle of the loan tenure, a more significant portion of the monthly payments goes towards your principal than to the interest. This system will go on until both the interest and principal is paid.

How to compute your monthly amortization

For convenience, you can use the bank loan calculator on the side or check out the online calculators of your chosen bank. But if you ever wonder how banks compute your monthly amortization, here is how they calculate it.

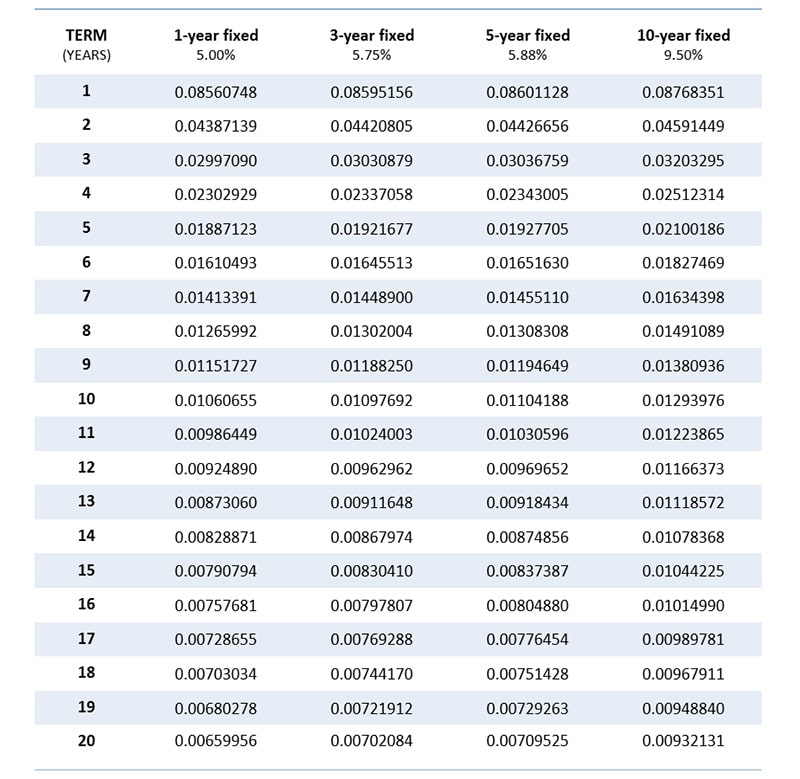

Factor Rate Table

Loanable Amount X Factor Rate = Monthly Amortization

For example, you want to buy a condo unit with a total contract price of Php 3,500,000. You paid 20% of TCP for down payment and wanted to finance the remaining 80% through a bank loan with a five-year fixed rate of 5.88% payable in 10 years.

Total Contract Price: Php 3,500,000

Down Payment: Php 700,000

Loanable Amount: Php 2,800,000

Interest Rate: 5.88%, 5-year fixed

Number of Years to Pay: 10 years

Factor Rate: 0.01104188Monthly Amortization = Loanable Amount X Factor Rate

= Php 2,800,000 X 0.01104188Monthly Amortization = Php 30,917.28 per month for 10 years

How to pay your monthly amortization the easy way?

When you found your dream home and secured an appropriate home financing, it is easy to think you can commit to your chosen mode of payment. However, sometimes life happens, you get distracted, and then you cannot pay on time.

In a housing loan, like in other kinds of credit, late payments can lead to unfortunate consequences. A late, a short or a non-payment can incur penalty charges. Late fees for one missed month may seem easy, but when allowed to accumulate for several months, then it starts to become a full-on headache. This can amass late payment fees and interests and can lead to default mortgage and foreclosed property.

So, instead of paying cash, sending checks, or charging credit card every month, here is a pro-tip: automate your payments.

Auto Debit Arrangement

An auto debit arrangement allows you to deduct scheduled payments against your registered bank account automatically. Auto debit is an electronic payment option that permits your lender to take payments directly from your account. With developers having partner banks, the amount is easily verified as coordination is easier between the developer, the bank, and the buyer. However, this arrangement is to be coordinated by the buyer directly to the bank who approved the loan and not the developer.

Postdated check

A postdated check is a check written by the payer for a date in the future. Most developers and banks require complete postdated checks for practical and convenient payment schedules. A postdated check can only be encashed or deposited on the date written on it.

When you automate your payments, you do not need to worry about making the deadlines. You only have to ensure enough funding for the registered accounts.

Now that you understand what payment options there are available to buy a real estate property, the next step is for you to evaluate the following: your real estate property of choice, the availability of payment options specifically for the unit you wish to buy, and most importantly, your financial capability during the time of purchase and future income projections.

Being a major investment decision, real estate purchase should be seen more as a business capital that is projected to bring in additional income in the future. If you know how to weigh the risks and prepared for the financial investment required, making a decision when and how is not a problem especially if you have saved enough from the start.

To learn about available real estate projects in the country’s central business districts, please check out the Property section of our website: Federal Land. Inc..