Property Outlook 2020: Philippines’ Real Estate Industry Remains Positive

Photo from Colliers

In recent years, the Philippines has become one of the hotspots for real estate investors in Southeast Asia. The growing economy and increasing middle class have made the country very attractive to both local and foreign investors.

This 2020, Colliers International Philippines is seeing a sustained property market over the next two years, but advises investors to recalibrate plans to adapt to the constantly evolving property landscape in the country.

“Overall, we see the Philippine economy’s upward growth trajectory being sustained by massive public infrastructure spending. The government spending-backed economic growth should further stoke the property sector,“ the real estate consultancy firm said in its report Outlook for 2020: Landlords and tenants recalibrate amid a constantly evolving property landscape.

OFFICE PROPERTY MARKET

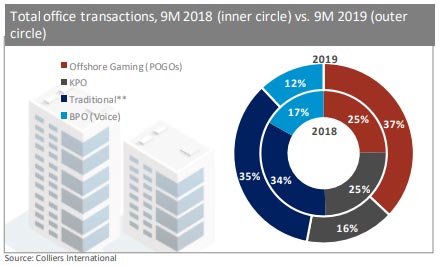

Colliers believes that the office property market demand drivers will remain diverse in 2020. Colliers has observed that the demand base started to diversify in the fourth quarter of 2016 and is expected to continue over the next twelve months. Traditional firms, business process outsourcing (BPO), knowledge process outsourcing (KPO) firms and POGOs are likely to dominate Metro Manila office space take-up in 2020.

Photo from Colliers

Meanwhile, Colliers sees several headwinds that might limit the office property market growth in the next three years. These include the lingering concerns on the sustainability of POGO firms, the uncertainty of the government’s tax reforms, and a lower Gross Domestic Product (GDP) growth projection. Multilateral lending firms such as the Asian Development Bank (ADB) are now projecting a 6.0% growth versus 6.2% of last year. A slower economy may slow down the expansion of traditional and non-outsourcing businesses. While the delayed approval of the Comprehensive Tax Reform Program which intends to reduce tax perks for foreign investors has compelled several outsourcing firms to take a wait-and-see stance.

RESIDENTIAL PROPERTY MARKET

Co-living residential projects within and on the fringe areas of central business districts will remain popular among young professionals who want to live near their workplace but cannot afford to buy or lease out condominium units within major CBDs. In 2020, Colliers sees developers continuously exploring opportunities in co-living projects, cashing in on the demand brought by the worsening traffic crisis in Metro Manila.

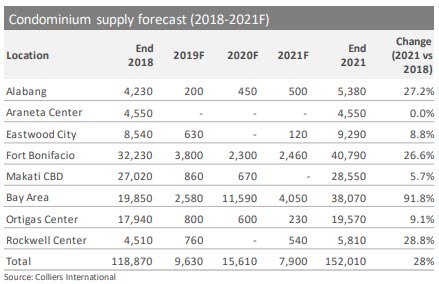

In terms of pre-selling condominium projects, Colliers sees sustained demand from investors and local and foreign employees. Colliers projects the delivery of about 15,610 units, outpacing the 10,700 units delivered from 2016 to 2018, a period that benefited from the trickle-down impact of offshore gaming demand.

Colliers also sees more joint venture projects between local real estate developers and their ASEAN counterparts in 2020. Joint venture projects with foreign firms are among the more expensive in the market, but take-up is strong. Colliers sees these partnerships thriving as foreign companies are enticed by sustained yields.

Photo from Colliers

“Metro Manila’s condominium stock should expand to 152,000 units by the end of 2021, a 28% rise from about 118,900 in 2018. Colliers sees Fort Bonifacio and the Bay Area covering more than 80% of new supply from 2019 to 2021. In our opinion, the pace of residential completion continues to move in step with the expansion of business activities in these business districts,” the property consultancy firm explained.

RETAIL PROPERTY MARKET

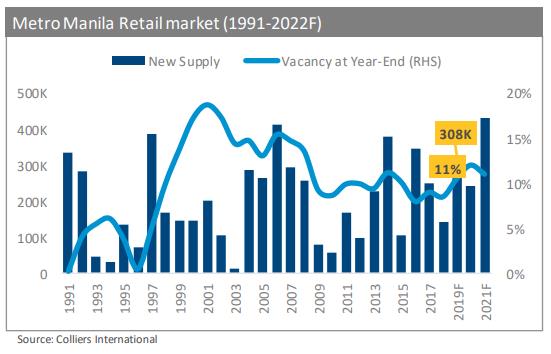

“We expect the completion of about 310,000 sq. meters of new retail space in 2020. Due to the substantial new supply, we see vacancy rising to about 12% with lease rates rising at a slower pace of 1.0% from 1.3% in 2019. In our opinion, mall operators should continue to implement innovative leasing strategies and attract interesting tenants to fill the substantial amount of new retail space,” Colliers said.

Photo from Colliers

Vacancy should decline back to about 11% by the end of 2021 given the take-up from new tenants and a slightly muted retail space completion metro-wide. Colliers believes that retail space absorption over the next 12 to 24 months should be supported by the completion of office and residential towers near malls located within major townships across Metro Manila. Aside from sustained demand from local consumers, retail sales should also be buoyed by the continued expansion of offshore gaming firms in Metro Manila.

“Colliers believes that a major opportunity for Metro Manila mall developers is the housing of flexible workspaces. Colliers has observed that flexible workspace operators are continuously looking for space across Metro Manila. But with office vacancies hovering between 0.5% and 1.0% in prime locations such as Makati CBD and the Bay Area, these operators have been scrambling to find suitable space,” Colliers added.

HOSPITALITY PROPERTY MARKET

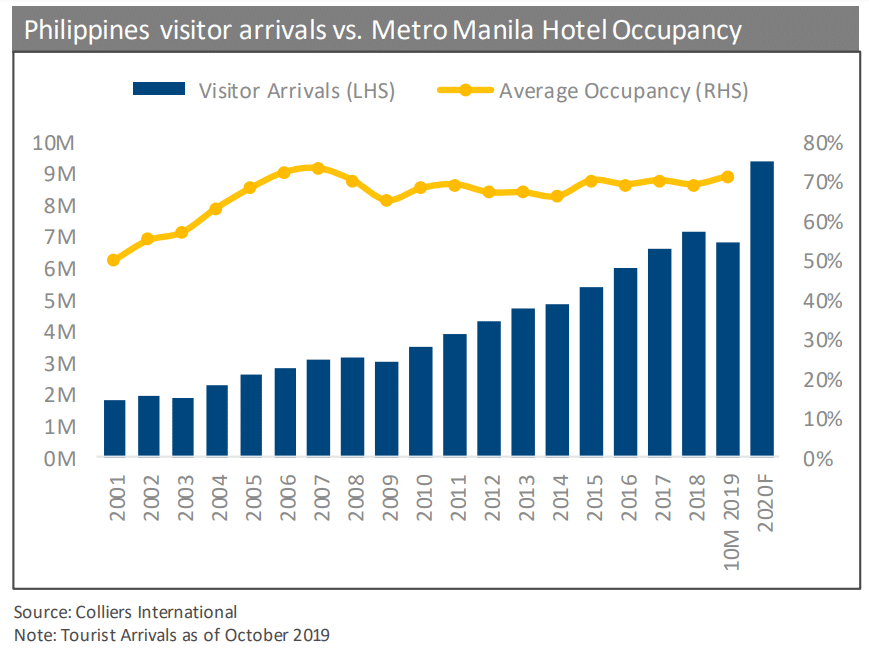

Colliers projects a 70% occupancy from 2020 to 2022 due to the rising number of foreign tourist arrivals. The continued rise of foreign tourists should sustain occupancy despite the expected delivery of about 3,300 hotel rooms. A key contributor to hospitality growth in the country is the rising number of Chinese tourists. While total foreign arrivals are growing by 10% per year from 2016 to 2018, Chinese tourists increased by about 37% per year during the same period.

“Over the next twelve months, we still see Chinese tourists driving the hospitality sector and contributing to higher hotel occupancy and spending in Metro Manila and other key destinations across the country,” Colliers said.

Photo from Colliers

The Grand Midori Ortigas

This 2020, top real estate developer Federal Land, Inc. is slated to launch several condominium projects in Metro Manila. Set in key areas such as Bay Area, Fort Bonifacio, and Manila, these condominium projects’ value is projected to surge even further in the coming years.

Federal Land also offers condominium units for sale in Quezon City and Ortigas CBD. For pre-selling reservations, email invest@federalland.ph or visit www.federalland.ph.