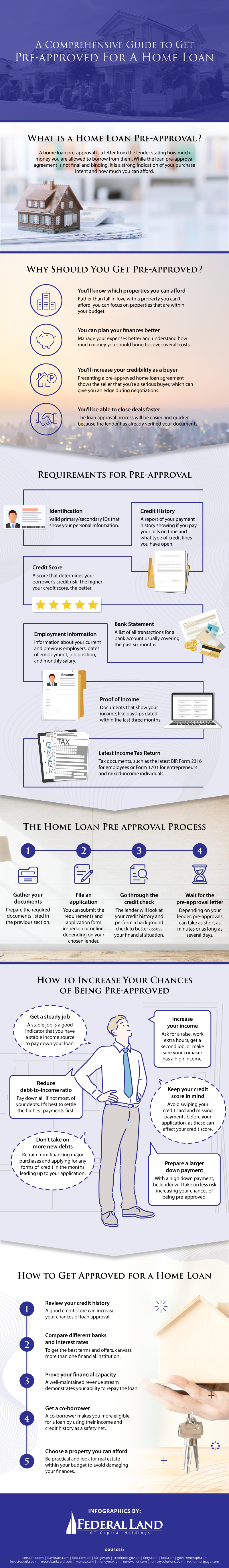

A Comprehensive Guide to Get Pre-approved for a Home Loan

What is a Home Loan Pre-Approval?

A home loan pre-approval is a letter from the lender stating how much you can borrow. While it isn’t the final loan agreement, it implies favorable results from the lender’s background check on your finances ⎯like debt, accounts, and income⎯and eligibility for their loan terms. Besides a loan estimate, a pre-approval letter includes your estimated monthly payment amount and interest rate. You’ll get a written statement once the lender pre-approves your home loan, which you may use to reassure property developers. After submitting your pre-approval letter, you can begin learning how to get approved for a home loan to secure your property’s financing.Why Should You Get Pre-Approved?

Pre-approval generally makes the process of home acquisition easier on your part. The advantages you’ll reap from getting pre-approved include the following:1. You’ll know which properties you can afford

A pre-approved loan gives you an idea of the maximum amount you can borrow so that you can focus on browsing properties within your budget. You may have to say goodbye to that penthouse unit you’ve been eyeing, but it means you’ll have a narrower set of options, making your choice easier.2. You can plan your finances better

It’s easier to plan your finances with a pre-approved loan. Since you already know the largest amount you may borrow, you can tell if the loan is enough to acquire your target property or whether to add more out of pocket to get the home you want.3. You’ll increase your credibility as a buyer

A pre-approved home loan makes you a more attractive buyer because it shows that you’re serious about purchasing a condo or a house and that your finances are in order. It also signals you’re less likely to receive a rejection letter for a home loan. All these factors can give you an edge during purchasing negotiations.4. You can close deals faster

A pre-approval from your lender makes obtaining a loan easier on the home stretch. You can present an offer much faster, preventing your target property from falling into the hands of competing buyers.Requirements for Pre-Approval

The following housing loan requirements are necessary during pre-approval for lenders to determine whether you can afford the monthly amortization.1. Identification

You must present valid primary and secondary IDs to submit a pre-approval form. These documents must contain your personal information, including the following:- Full name

- Social security number

- Date of birth

- Marital status

- Educational attainment

- Address

- Number of dependents

2. Credit history

Lenders examine your credit records to see how responsible you are as a borrower based on how you use credit. The more accountable you are, the more likely the lender will offer a higher amount and favorable loan terms.3. Credit score

It’s a common misconception that the Philippines doesn’t have a credit score system. The country does have one, and many financial institutions use it to assess a borrower’s credit risk. Credit scores range from a low 300 to a high 850. A higher score encourages lenders to offer better loan terms, minimizing expenses over time. You may request a comprehensive credit report with your score from the Credit Information Corporation (CIC) and use it to demonstrate your responsibility as a borrower.4. Bank statement

A typical housing loan bank requirement is a statement of account listing your transactions from the past six months. It proves you have enough money to cover the down payment and closing costs and whether you have a steady income stream to pay your mortgages.5. Employment information

Lenders prefer to give loans to borrowers who have stable employment. As such, they may review your pay slips and call your employer for employment and salary verification. Meanwhile, if you’re self-employed, you’ll need to provide additional documents about your business, such as:- Business permit

- Securities and Exchange Commission (SEC) registration

- Department of Trade and Industry (DTI) certificate

6. Proof of income

You must present verifiable documents indicating your monthly salary, such as pay slips, a certificate of employment indicating your monthly income, or the latest audited financial statement (AFS) with a bank or Bureau of Internal Revenue (BIR) stamp. These records prove you have a stable revenue stream to meet your monthly amortizations.7. Latest income tax return

Aside from your salary, your tax documents will verify whether your declared income is legitimate, giving lenders additional security and reassurance. If you’re locally employed, you may submit your latest BIR Form 2316, while your latest BIR Form 1701 suffices if you are a freelancer or have a business.The Home Loan Pre-Approval Process

Understanding how loan pre-approvals work can help you navigate the process and make the best choices at every step.1. Gather your documents

When submitting documents, you must identify what banks generally want and look up your preferred lender’s requirements to identify the specific documents you need.2. File an application

Once you find a lender with rates and fees that meet your financial capacity, the next step is to complete the necessary application forms and submit the requirements online or in person.3. Go through the credit check

While reviewing your application and finances, the lender will perform a credit check and review your credit report, history, and score to determine your eligibility for pre-approval. You could check your report before applying to resolve any issues before you apply.4. Wait for the pre-approval letter

Once the lender finishes assessing your credit and financial profile, they’ll issue a letter stating whether you’re pre-approved for a loan and how much you can borrow. Waiting times may vary from minutes to several months. You can present the letter to a property seller for verification and use it during purchasing negotiations.How to Increase Your Chances of Being Pre-Approved

Getting pre-approved may seem like going through the eye of a needle, but the following practices can increase your chances of a favorable outcome and bring you closer to acquiring your dream home.1. Increase your income

A high income indicates you have enough resources to cover your debt. Before proceeding with the pre-approval process, consider increasing your salary by working longer hours, negotiating for a raise, or finding another legitimate source of revenue. If you choose the latter, file your taxes for it to appear on your records.2. Get a steady job

An unstable income is a turn-off for lenders since you can’t reassure them that you’ll keep up with your loan obligations without a regular job. So, before applying for pre-approval, ensure you have planted your professional roots and been with the same employer for at least two years. The same tenure requirement applies to business owners and freelancers.3. Reduce debt-to-income ratio

Your debt-to-income ratio measures how your outstanding debt compares to your income—the lower your debt, the better. Hefty liabilities may discourage the lender from letting you borrow money because they can’t ascertain your discipline or ability to keep up with loan payments. So, start repaying your debts to improve your debt-to-income ratio.4. Keep your credit score in mind

A credit score of at least 700 is a good credit standing. Request a report from the CIC to ensure your score is favorable. If it isn’t, work on fixing mistakes and improving your standing by paying bills and reducing liabilities.5. Don’t take on new debts

Avoiding new debts is just as important as repaying existing obligations, as your efforts become meaningless if you’re only replacing old liabilities with new ones. As much as possible, try holding off large purchases and other loans until you’ve secured a home loan.6. Increase your down payment amount

Lenders favor financially responsible borrowers, and nothing shows you’re a big saver like presenting a sizeable down payment. A higher down payment lessens your need to borrow, making your prospect appealing to lenders.How to Get Approved for a Home Loan

All things considered, you must remember that pre-approval isn’t final and only shows how much you can borrow from the lender. So, let’s discuss how to apply for a housing loan to finalize your real estate financing once you get pre-approved.1. Review your credit history

Before submitting a home loan application, review your credit history while clearing unpaid balances and loans, which are potential red flags for lenders. Also, consider getting a certificate of payment for every repaid loan to avoid unwanted issues down the line.2. Compare different banks and interest rates

When you finally apply for a home loan, you could get pre-approvals from several banks and pick the one with offers, interest rates, and terms that meet your interests. That way, even if one lender rejects your application, you still have multiple alternatives.3. Prove your financial capacity

Even after receiving a pre-approval letter, you must consistently prove your ability to pay off the loan for the lender to process your application. They’ll examine your income, credit history, and debt-to-income ratio to evaluate whether you can afford your final monthly amortization. So, prepare all your relevant financial documents to avoid delays and setbacks.4. Get a co-borrower

Co-borrowers are additional debtors whose separate income and credit history count on your application. They’re usually spouses, family members, and other trusted partners willing to help finance your prospective property. Getting a home loan with a co-borrower isn’t mandatory, but paying the mortgage with someone can make it easier for you to qualify for your loan—sometimes even for a more significant amount. Talk to your lender about their co-borrowing requirements as early as pre-approval.5. Choose a property you can afford

Your pre-approval letter states the maximum loan amount you’ll receive. Stay within your financial capacity, as doing otherwise may damage your finances in the long run. For instance, consider pre-selling versus RFO properties—the former are generally more cost-effective, although you must wait years to acquire one.Acquire the property of your dreams

Purchasing a home is a considerable investment, and you may need financing to make it happen. Thankfully, getting pre-approved increases your chances of securing a loan. A pre-approved home loan can help get your finances in check during the initial stages of your application so that you won’t have to deal with any mishaps once the loan process starts. Armed with a commitment letter, many homebuyers then consider an Ortigas condo for sale to secure favorable terms, often at pre-selling condo Ortigas in The Grand Midori Ortigas, where developers honor pre-approval status with priority unit allocation. Real estate developers in the Philippines with convenient and flexible payment terms like Federal Land make your purchase easier. Federal Land has a simple acquisition process and flexible payment terms for your convenience. Check out Federal Land’s RFO units in One Wilson Square for a high-quality property in San Juan City. Contact them to learn more!

Melecio Martin G. Arranz IV

Digital Marketing Head

Martin is an experienced marketer with over 16 years of experience across various industries including real estate, banking and finance, technology, and advertising.

Martin has a broad range of expertise in having handled campaigns, brand launches, activations both in the traditional and digital space. Currently serving as the Digital Marketing Head at Federal Land, Martin leads a team focused on managing digital sales and platforms for the residential, estates and commercial business units.

linkedinINQUIRE NOW

Let us know what you are looking for. Get updated portfolio delivered straight to your inbox.